|

Historically, the Fed chair has presented the Fed's economic forecasts to Congress twice a year with the Federal Reserve's semi-annual monetary policy report to Congress. Within the extensive report that is compiled, the Fed included forecasts for key indicators such as GDP (real & nominal), the PCE price index (because it is preferred to the CPI), and the civilian unemployment rate. Fed district presidents and governors each provided their forecasts which are compiled to form a consensus -- or central tendency. On November 20, 2007, the Federal Reserve changed its policy of how frequently and when it would release its forecasts. The Fed now releases economic projections four times a year (every other FOMC meeting). When the increased frequency of forecasts was first introduced, projections made by members of the Board of Governors and Federal Reserve Bank presidents were published with the minutes of the FOMC meetings scheduled for January, April, June, and October (sometimes early November instead of late October). The Fed changed the timing of the forecasts on May 16, 2012 to be on a more quarterly pattern with forecasts released after FOMC meetings in the third month of a quarter.

When the Fed began to have post-FOMC press conferences held by the chairman (April 27, 2011) to explain the latest forecasts, the forecasts began to be released the afternoon of those FOMC meeting statements. With the greater frequency of these forecasts, they have become more valuable to the markets in terms of providing more timely hints on whether the Fed is likely to make a policy change in the near term. "Fed Speak" has gotten even more attention as Fed officials can now reference their own individual views on whether the economy is tracking the latest forecast or not. The Fed forecasts became even more valuable with the January 24-25, 2012 FOMC meeting when the Fed began releasing its forecast for the fed funds rate and for the timing of the next policy rate change.

Note: The forecasts for the fed funds rate are not published as ranges but as anonymous individual point forecasts by individual FOMC participants for end of year rates. This is discussed further below.

These forecasts will be updated by the Fed on December 17, 2014 at the same time as the FOMC statement and shortly before the chair's press conference.

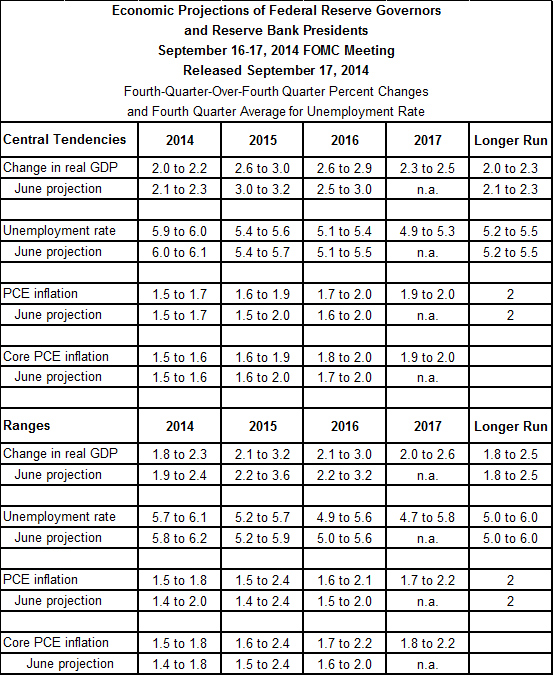

These economic projections are compilations of the forecasts of individual Federal Reserve Board governors and individual Federal Reserve District Bank presidents. The range for each variable in a given year includes all participants' projections, from lowest to highest, for that variable in the given year; the central tendencies exclude the three highest and three lowest projections for each variable in each year.

|

||||||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

|||||||||