|

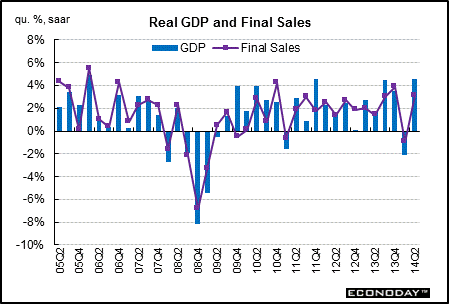

Long Term Perspective GDP measures total domestic production quarterly. Final sales reflect demand by consumers, businesses, and government. When final sales grow much faster than GDP for at least two quarters, it signals the need to rebuild inventories. That means production increases and so does GDP. Notice that over the long run, real final sales and real GDP grow by roughly the same magnitude.

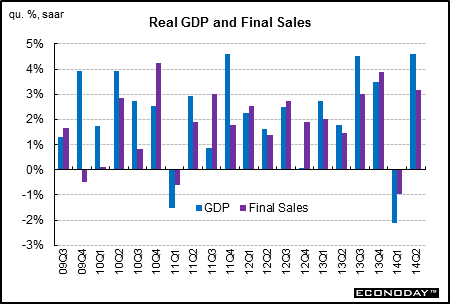

Short Term Perspective The second quarter rebounded more than expected from the adverse weather impacted first quarter. While there were a number of strong components, the rebound was led by inventory growth. The advance estimate for the second quarter posted at a healthy 4.0 percent annualized, following an upwardly revised decline of 2.1 percent in the first quarter (previously down 2.9 percent).

Final sales of domestic product rebounded 2.3 percent after dipping 1.0 percent in the first quarter. Final sales to domestic purchasers gained 2.8 percent in the second quarter, compared to 0.7 percent in the first quarter. The final revision to second quarter GDP growth showed an upward revision to 4.6 percent from the prior estimate of 4.2 percent and compared to the first quarter decline of 2.1 percent. The revision matched expectations. The latest second quarter number is the fastest growth rate since the fourth quarter of 2011—also 4.6 percent.

Upward revisions primarily came from nonresidential fixed investment, residential investment, and exports.

Broad demand numbers also were revised up. Final sales of domestic product were boosted to 3.2 percent, compared to the second estimate of 2.8 percent and a first quarter decline of 1.0 percent. Final sales to domestic purchasers (which exclude net exports) were increased to 3.4 percent, compared to the second estimate of 3.1 percent and a first quarter rise of 0.7 percent.

Looking at growth rates (instead of the direction and degree of component revisions), strength for the second quarter was broad based in inventory investment, net exports, nonresidential fixed investment and residential investment. Personal consumption also was healthy.

|

|||||||

| Legal Notices | ©Copyright 1998-2024 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||