|

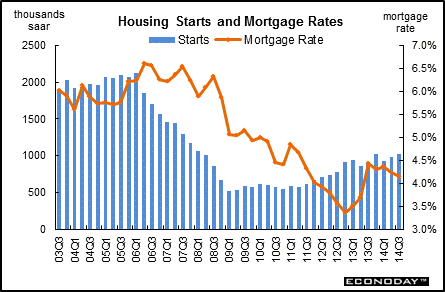

Long Term Perspective Income and interest rates are the two key factors that affect housing activity. More housing construction translates into increased demand for furniture and appliances as consumers refurnish their new homes. In the current business cycle, housing construction appears to have peaked in 2005 even as interest rates began to head higher. Starts were sharply lower in 2006 and 2007 in response to higher mortgage rates and unsold housing inventories. Tighter lending standards and the credit crunch helped push starts lower in the second half of 2007 and that trend continued into early 2009. A thawing in mortgage markets and an improved economic outlooks helped starts stabilize in 2009. Two rounds of special tax credits also boosted home sales in the summer and autumn of 2009 and spring 2010, leading to an incremental rise in starts during early 2010. During latter 2010, starts edged down on heavy supply of new homes and lackluster sales. Starts showed mild improvement in 2011 and gained moderate momentum in 2012. A gradual sell-off of housing inventory and very low mortgage rates led to modest improvement in starts in 2012 and most of 2013. Atypically adverse winter weather lowered the first quarter 2014 average although there was monthly improvement during the quarter, followed by a second quarter rebound—on average for the quarter.

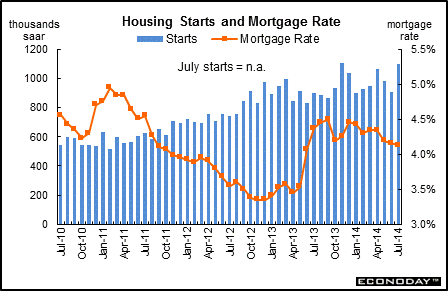

Short Term Perspective Housing data continue to be volatile. Starts and permits rebounded in September after declines in August after sharp gains in July. Housing starts for September rebounded 6.3 percent after dropping 12.8 percent in August. September's pace of 1.017 million units was up 17.8 percent on a year-ago basis.

The multifamily component rebounded a monthly 16.7 percent after plunging 28.7 percent in August. The single-family component rose 1.1 percent in September, following a 2.0 percent decline the prior month.

Building permits made a comeback, too. Permits increased 1.5 percent in September, following a 5.1 percent drop in August. Permits posted at 1.018 million units annualized, coming in a little below expectations for 1.027 million. September permits were up 2.5 percent on a year-ago basis.

Overall, housing made a comeback from a weak August and remains on a low trajectory. Upcoming numbers for housing sales will play a key role in whether construction growth improves or not. More recent data on mortgage purchase applications and homebuilder traffic numbers have not been inspiring and add to the low trajectory view.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||