|

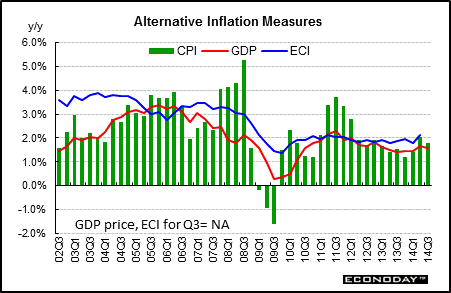

Long Term Perspective The GDP price index is the broadest measure of price inflation faced by consumers and producers, yet it gets less attention than the CPI or the employment cost index (ECI). During the recent recession, ECI inflation exceeded the other two and GDP inflation outstripped CPI price inflation. GDP has some components with typically high productivity such as producers' durable equipment, software, and nonresidential construction. During early 2009, energy turned the headline CPI negative but that reversed in the final quarter of 2009 on a year-ago basis and accelerated in early 2010 on a year ago basis, and remained high into mid-2011. A slower recovery pulled inflation down in 2012 and into 2014 although second quarter numbers firmed.

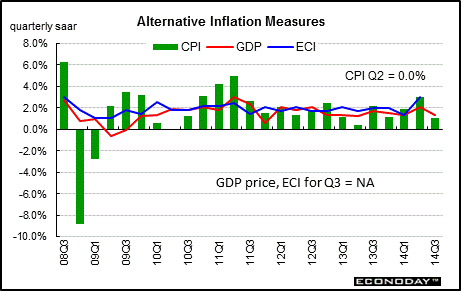

Short Term Perspective The ECI rose at a faster SAAR pace in the second quarter, coming in at 3.0 percent, up from 1.3 percent in the first quarter. The CPI has whipsawed the last two years on swings in oil prices. In the third quarter of 2014, the headline CPI decelerated to 1.1 percent from 3.0 percent the prior quarter. The GDP price index showed economy-wide inflation in the third quarter slowing to 1.3 percent, compared to 3.0 percent in the second quarter. The second quarter and first quarter swing in the GDP price index were largely related to oil prices. Separately, the GDP price index includes sluggish components of residential and nonresidential structures not found in the CPI or ECI.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||