|

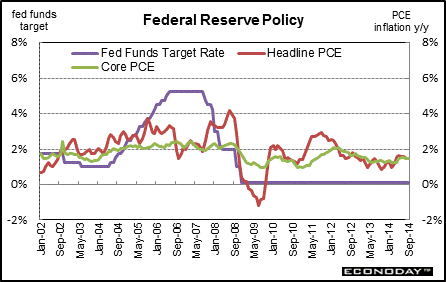

Long Term Perspective The current rate cutting cycle began on September 18, 2007, after the subprime crisis roiled the financial markets, with the Fed cutting the fed funds target rate from 5.25 percent in mid-2007 to a target range of zero to 0.25 percent, established December 16, 2008. Never before had the Fed set a publicly announced range for a target. With the December 15-16, 2008 meeting announcement the Fed stated that the fed funds rate likely would remain at those levels "for some time."

Since the FOMC essentially cannot cut the fed funds rate any further, the Fed has focused on quantitative easing or credit easing. After cutting the fed funds target to a record low of a range of zero to 0.25 percent on December 16, 2008, the Fed really had no further room to cut and has left the target unchanged through the October 28-29, 2014 FOMC meeting.

The real (inflation-adjusted) rate of interest (here, the fed funds rate relative to inflation) indicates the degree of constraint in the financial market and the real fed funds rate has swung sharply over the last ten years in a number of cyclical swings. In this case, the federal funds rate (controlled by the Fed) is compared to the yearly change in the core personal consumption expenditure price index, that is, the PCE price index excluding food and energy prices. In recent years, a soft global economy has led to slower inflation although more recently inflation has firmed due to gradual improvement in U.S. economic growth.

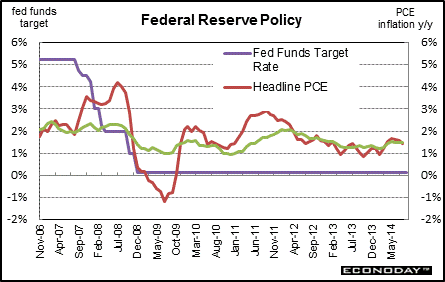

Short Term Perspective At the Fed's January 24-25, 2012 FOMC meeting, it announced a specific long-term inflation goal of 2 percent. With the December 11-12, 2012 FOMC meeting announcement and confirmed through the March 18-19, 2014 meeting, the Fed switched to guidance based on unemployment and inflation indicators. But there have been recent changes in guidance wording. At the January 28-29, 2014 meeting, the Fed said "that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal." At the March 18-19, 2014 FOMC meeting, the specific 6.5 percent unemployment rate was dropped from guidance and the focus became general labor market conditions and the Fed's long-term inflation goal. This continued through the July 29-30, 2014 meeting.

Turning to quantitative easing, after the December 17-18, 2013 FOMC meeting, the Fed began to taper its long-term bond buying programs or quantitative easing. In January 2014, purchases of mortgage-backed securities were reduced to a monthly $35 billion—down from the prior $40 billion per month. At the January 28-29, 2014 FOMC meeting, the Fed announced further taper of $5 billion monthly in each of it bond purchases programs—mortgage-backed securities and Treasuries, leaving monthly asset purchases at $65 billion starting in February 2014. The FOMC statement said that further taper would continue in "measured steps" if the economy continued as forecast. At the October 2014 meeting, the Federal Reserve FOMC announced as expected that it ended its bond purchase programs. It also dropped its characterization of labor market slack as "significant" in a show of confidence in the economy's prospects. In its statement, the FOMC largely dismissed recent financial market volatility, dimming growth in Europe and a weak inflation outlook as unlikely to undercut progress toward its unemployment and inflation goals. The fed funds rate range remained at zero to 0.25% where it has been since December 2008. The FOMC said that it would likely remain near zero for a "considerable time" following the end of the bond purchases this month. The timing and pace of interest rate increases would be data dependent.

Minneapolis Fed President Narayana Kocherlakota was the only FOMC member who dissented saying that the committee should make a bolder commitment to meet its 2% inflation target given a lack of price pressures. The Fed acknowledged lower energy prices and other forces were holding inflation down, but repeated its view that the likelihood of inflation undershooting its target had diminished since earlier this year.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||