|

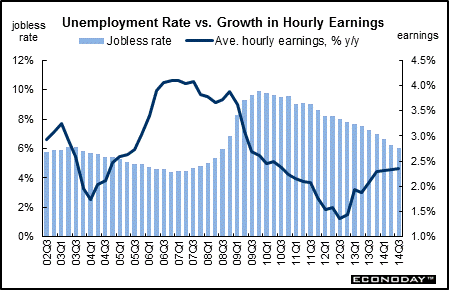

Long Term Perspective When the economy is operating at full throttle, a falling unemployment rate worries policymakers as they anticipate that rapidly rising wages will turn into runaway inflation. In fact, wage growth did accelerate in 2005 and over most of 2006 as the jobless rate headed lower. But the reverse has been true during the past recession and early recovery. A rising jobless rate often alleviates wage pressures but is typically associated with economic recession. Federal Reserve policymakers aim for balanced growth with very low inflation.

The unemployment rate rose sharply over the latest recession and even into early economic recovery. At the business cycle peak in December 2007, the unemployment rate had already risen by just over half a percentage point to 5.0 percent from the cycle low of 4.4 percent. Job weakness accelerated during 2008 as the unemployment rate jumped to 7.4 percent in December 2008. Conditions worsened even further in 2009 as the unemployment hit a 10.0 percent in October 2009—the cycle peak and highest rate since mid-1983.

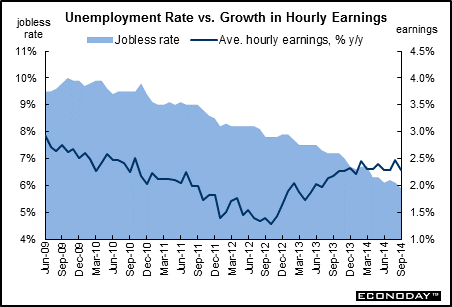

Short Term Perspective With modest to moderate economic growth during the recovery, the unemployment rate hit a recent low of 5.9 percent in September 2014. However, some of the improvement since the end of recession has been due to a low labor force participation rate—partially a sign of economic weakness instead of strength. The low labor force participation rate is due to discouraged workers and demographics (baby boomers retiring). Nonetheless, there has been moderate job growth helping to pull down the unemployment rate. The Fed has been surprised by the relatively rapid recent drop in the unemployment rate and now focuses on a broad range of labor market indicators.

During much of the recent overall economic recovery, average hourly earnings growth decelerated sharply from the cyclical peak. However, there has been an uptrend since the end of 2012. The year-ago pace in September 2014 came in at 2.3 percent, down from 2.5 percent in August. This latest number compares to the prior cycle peak set in December 2006 of 4.22 percent (other months round to 4.2 percent but are not as high at higher decimal precision). The improved but still soft wage rate is seen by many members of the FOMC as allowing continued easy monetary policy.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||