|

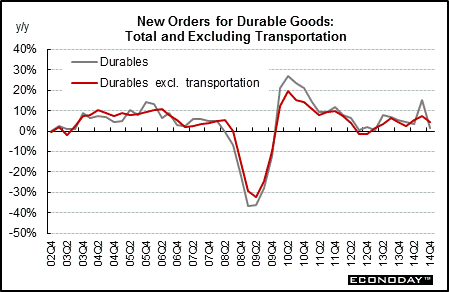

Long Term Perspective New orders for durable goods reveal demand for consumer goods such as cars and home appliances as well as investment equipment such as lathes and computers. Transportation is a relatively volatile component within durables orders due to the lumpy nature of aircraft orders—civilian and defense. Analysts prefer to follow durables excluding transportation in the short-term to see the underlying cyclical trend. Over the long run durables overall and excluding transportation tend to track each other.

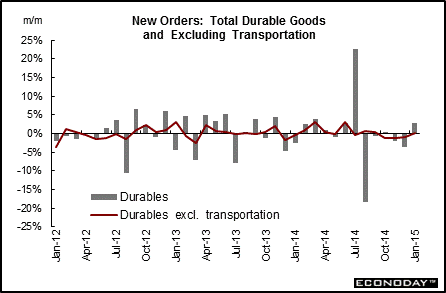

Short Term Perspective Durables orders rebounded 2.8 percent in January after dropping 3.7 percent in December. Excluding transportation, the core was flat after slipping 0.8 percent in December.

Transportation rebounded 9.7 percent, following a monthly plunge of 10.0 percent the prior month. Motor vehicles were flat, nondefense aircraft surged a monthly 128.7 percent , and defense aircraft decreased 6.5 percent.

Outside of the core, orders were mixed. Industries that advanced were machinery, computers & electronics, and "other." Declines were seen in primary metals, and electrical equipment.

Nondefense capital goods orders excluding aircraft rebounded 0.6 percent after declining 0.7 percent in December. Shipments of this series slipped 0.3 percent in January after dipping 0.3 percent the previous month.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||