|

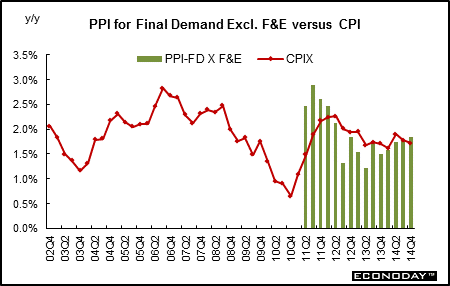

Long Term Perspective A slowing in the recovery eased the CPI core rate during 2009 and early 2010. Weak housing, in particular, softened the core CPI through shelter costs. But in early 2011, a strengthening economy boosted the core PPI for final demand while the core CPI lagged somewhat. By mid-2011 and through early 2012, an improvement in rent and motor vehicle components helped the core CPI to rise from a depressed pace. The revamped core PPI still is more volatile than the core CPI—but to a far lesser degree. A softening in the recovery caused both to decelerate in latter 2012 through 2014.

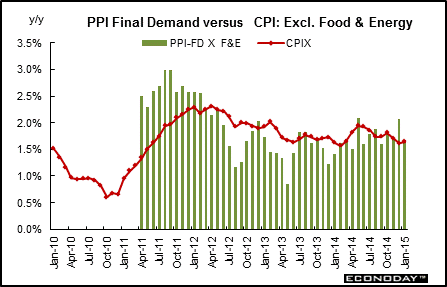

Short Term Perspective A soft economy and stronger dollar led inflation pressures to soften in 2012 through early 2015. This was despite moderate acceleration in the shelter component in the CPI. But the core series temporarily warmed in early 2014 and softened mid-year. The core CPI on a year-on-year basis in January stood at 1.6 percent, following 1.6 percent for the prior month. That for the core PPI for final demand posted at 1.7 percent versus 2.1 percent in December.

|

|||||||

| Legal Notices | ©Copyright 1998-2024 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||