|

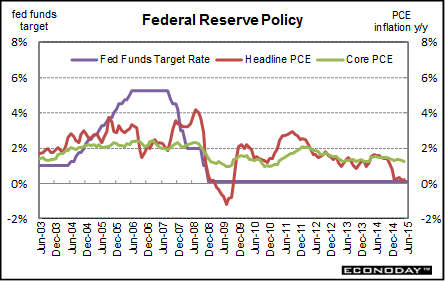

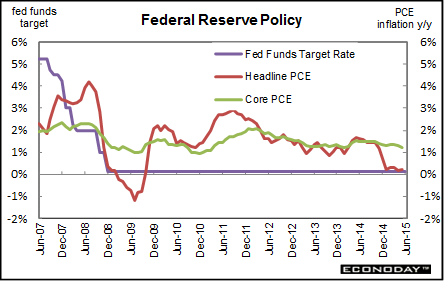

Long Term Perspective The current rate cutting cycle began on September 2007 after the subprime crisis roiled the financial markets, with the Fed cutting the fed funds target rate from 5.25 percent in mid-2007 to a target range of zero to 0.25 percent, established in December 2008. Never before had the Fed set a publicly announced range for a target. With the December 2008 meeting announcement, the Fed stated that the fed funds rate likely would remain at those levels "for some time." In fact, the Fed has left this target unchanged through the July FOMC meeting. Since the FOMC essentially could not cut the fed funds rate any further, policy makers focused on quantitative easing or credit easing through 2014.

The real (inflation-adjusted) rate of interest (here, the fed funds rate relative to inflation) indicates the degree of constraint in the financial market and the real fed funds rate has swung sharply over the last 10 years in a number of cyclical swings. In this case, the federal funds rate (controlled by the Fed) is compared to the yearly change in the core personal consumption expenditure price index, that is, the PCE price index excluding food and energy prices. In recent years, a soft global economy has led to slower inflation.

Short Term Perspective In the July FOMC statement, the Fed upgraded its assessment of the labor market but only slightly, describing job growth as "solid" and the unemployment rate as "declining". In a subtlety, the Fed said that "some" further improvement is needed in the labor market vs just further improvement in the June statement. This could imply that the bar for job improvement has been lowered slightly. Inflation was described as subdued. Guidance remained in place, that the Fed is data dependent on a meeting-to-meeting basis. The next meeting is in September. The general outlook for policy liftoff is either September or December. There were no dissenting votes.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||