|

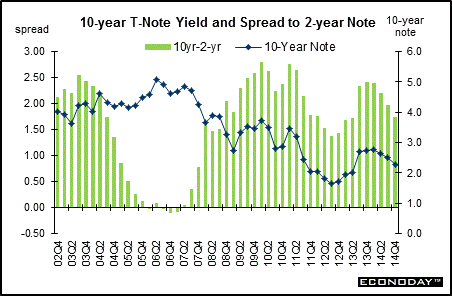

Long-term perspective The spread between long and short interest rates tends to widen near economic downturns and narrows during recovery/expansion. The spread fell over the late 2003 through 2006 period and it appears to have been related to a rise in near-term credit demand and a rise in near-term inflation expectations while longer-term inflation expectations held steady. From the end of 2007 and through 2009, flight to quality and the past recession sharply depressed the two-year rate while the ten-year bond did not decline as much due to a boost in inflation expectations at the time. With the sluggish recovery and low core inflation, soft rates continued in 2010, 2011, 2012, and into early 2013 before gaining in latter 2013 and in 2014 on Fed taper.

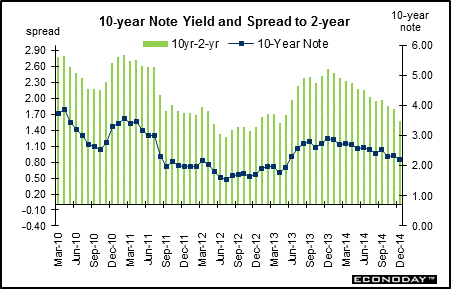

Short-term perspective In January 2012, the Fed stated that exceptionally low rates were likely through late 2014. At the September 2012 meeting, guidance language was changed to mid-2015 and this stance was affirmed in October 2012. But at the December 2012 FOMC, the Fed switched guidance from date based (mid-2015) to indicator based. The Fed planned to keep rates exceptionally low even after the unemployment rate declined to below 6.5 percent and inflation expectations did not exceed 2.5 percent. But at the March 2014 FOMC, the Fed removed the unemployment rate number in acknowledgment that the unemployment rate was low relative to overall labor market conditions. The Fed now is focusing on general labor market conditions. This stance continues to weigh on the 2-year T-note although it has firmed in response to planned measured steps in taper. Also the Fed has stated that policy rates will remain low for a considerable period after taper of quantitative easing concludes—in October 2014. This note also has been a favorite when flight to safety has been sought—such as with the sovereign debt crisis for several European countries or geopolitical crises in Ukraine, Gaza, or Greece. In December the spread nudged up 1 basis point to 196 percentage points. This reflected the average yield on the 10-year note gaining 11 basis points to 2.53 percent and the 2-year note rising 10 basis points to 0.57 percent.

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||