|

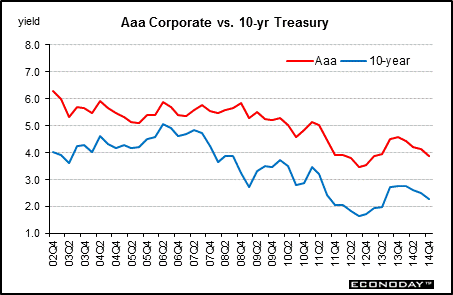

Long term perspective In 2000, the U.S. Treasury announced that it would borrow less and therefore issue fewer securities. This lifted prices of Treasury securities and reduced their yield. However, this move by the Treasury did not mean that corporate bond yields would be lower as the two markets are somewhat independent. So the gap between corporate bond and Treasury yields widened. In 2001 and 2002, the gap widened further – at that time caused by deteriorating credit conditions in a softening economy. The gap narrowed slightly from 2003 to 2006 but widened in 2007 and into early 2009 over subprime problems and their impact spreading to other sectors. The gap narrowed during the second half of 2009 and into early 2010 as the economy began recovery and flight to safety reversed somewhat. When the Fed announced a second round of quantitative easing in mid-2010, Treasury rates were under a little more downward pressure. So-called QE2 ended in the second quarter of 2011 but the economy turned sluggish in 2011 and into 2012 while worries over European sovereign debt weighed on Treasury rates due to flight to safety. The Fed's additional quantitative easing weighed on rates in late 2012 and into mid-2013. Despite upward pressure latter 2013 and in 2014 as taper of quantitative easing became more apparent and actual in 2014, rates eased on slower global growth.

The corporate bond rates are from Moody's. This company has a slightly different nomenclature for its ratings, compared to Citigroup's ratings. Moody's broad categories begin with a capital letter (A, B, or C with A being the highest quality and lowest credit risk). Each broad category is differentiated into further subdivisions with a lower case "aa," "a," or no additional letter. The following are in descending order of quality – Aaa, Aa, and A. Citigroup's ranking system uses all capital letters. According to Moody's, obligations rated Aaa are judged to be of the highest quality, with minimal credit risk.

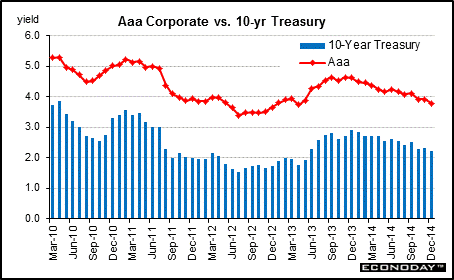

Short term perspective Corporate bond rates remained elevated in early 2010 but then eased on signs of slippage in recovery, increased concern about European sovereign debt, and on the start of QE2. Recently, during 2013, rates firmed on expectations of Fed taper. In 2014, yields softened on slower global growth. The yield on 10-year Treasuries dipped 12 basis points in December 2014 to 2.21 percent while the average yield on Aaa corporate bonds declined 13 basis points to 3.79 percent.

|

|||||||

| Legal Notices | ©Copyright 1998-2024 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||