|

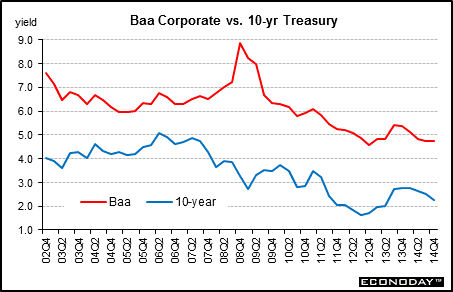

Long term perspective Improved economic data and stabilized credit markets lowered yields on Baa corporate bonds throughout much of 2009 and into 2010. During the first half of 2011, corporate rates had settled into a narrow range. In summer and early autumn 2011, corporates rates eased notably on increased recession fears and due to the increased attractiveness of these bonds compared to equities. Rates steadied somewhat in late 2011 as economic news for the U.S improved although risk in Europe kept U.S. bonds attractive. In early 2012, Treasury yields nudged up as an easing of contagion fears over European sovereign debt has offset sluggish economic data but turned back down soon in 2012 as contagion fears returned. In 2013 and early 2014, soft global growth and flight to safety partially offset concerns about Fed taper—which did lift rates somewhat.

Note that the spread between the Baa Corporate and the 10-year Treasury note is wider than the spread between the Aaa corporate bond and the Treasury security. This reflects market views of credit conditions among these lower rated corporate bonds.

According to Moody's obligations rated Baa are subject to moderate credit risk. They are considered medium-grade and as such may possess certain speculative characteristics.

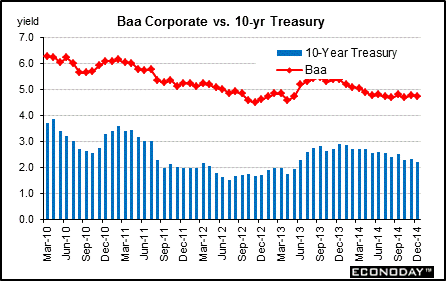

Short term perspective Rates firmed in early 2013 on improved economic indicators but dipped in late spring on soft economic news. Taper talk boosted yields in mid-2013 (monthly averages). After no taper in September 2013's FOMC meeting, rates were softer in October and November but rates firmed in late 2013 and early 2014 on stronger belief in taper. Soft global growth and flight to safety on geopolitical issues tugged down on rates from spring 2014 to the end of year. Yields on Baa rated corporate bonds dipped 5 basis points in December 2014 to 4.74 percent while the 10-year Treasury note yield rose eased 12 basis points to 2.21 percent. When yields on lower rated bonds do not fall as much as yields on higher rated bonds or rise more during periods of rising rates, it suggests that default risk has risen (usually this happens during periods of economic slowing or recession).

|

|||||||

| Legal Notices | ©Copyright 1998-2025 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||