|

“We’re being patient and letting restrictive monetary policy do its work,” Jerome Powell told a banking conference. He said the US labor market remains “very strong” in comments that help put April’s employment report into context, data that missed forecasts but were nevertheless still solid. As for inflation, Powell noted the pace over the past year has slowed by half although this year’s first quarter was notable “for its lack of progress”. He expects inflation to move back down but “my confidence is not as high as it was.” He said we’re “just going to have to see where it goes.”

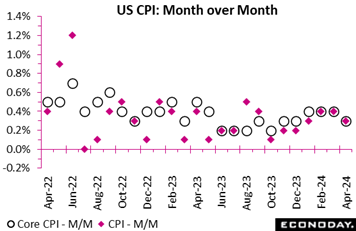

Econoday's consensus medians for April all hit the bullseye: US consumer prices rose 0.3 percent on the month and 3.4 percent on the year and rose 0.3 and 3.6 percent when excluding food and energy. For Federal Reserve policy the results point unfortunately to no more than incremental cooling at still high levels and won't be pulling forward the long-awaited rate cut. Econoday's consensus medians for April all hit the bullseye: US consumer prices rose 0.3 percent on the month and 3.4 percent on the year and rose 0.3 and 3.6 percent when excluding food and energy. For Federal Reserve policy the results point unfortunately to no more than incremental cooling at still high levels and won't be pulling forward the long-awaited rate cut.

Headline prices have been lower, at 3.1 percent as recently as January, and though the core is now at a two-year low it is still 1.6 percent points above the Fed's target.

Services are the Fed's main concern, rising 0.4 percent for annual inflation of 5.3 percent. Until services begin to tangibly cool, the Fed won't be comfortable cutting rates. Goods, by contrast, remain very favorable, down 0.1 percent less food and energy commodities for 1.3 percent annual contraction.

Energy has been driving inflation higher in recent months, rising 1.1 percent in both April and March though the annual rate is up only 2.6 percent. More central for monetary policy is shelter which remains a fixed source of pressure, rising 0.4 percent for a third straight month and up 5.5 percent on the year. Shelter and energy together contributed over 70 percent of the overall monthly increase.

Food has been flat showing virtually no change over the past three months and up only 2.2 percent on the year. Price weakness for vehicles remains pronounced, falling 0.4 percent for new vehicles for a third straight monthly decline and down 0.4 percent on the year. Used cars and trucks fell 1.4 percent for 6.9 percent annual contraction.

Progress on the price front is being made but the pace, because of services and also shelter, is agonizingly slow.

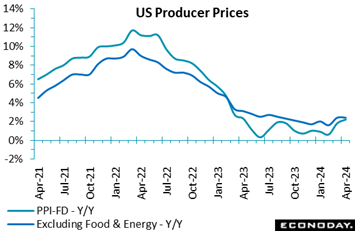

Producer prices in the US also proved sticky in April with the headline index up 0.5 percent after edging down 0.1 percent in March. The 12-month rate rose to 2.2 percent from 1.8 percent, the highest level in a year. Excluding food and energy, the index was also up 0.5 percent on the month and the 12-month rate came in at 2.4 percent, just above the 2.3 percent consensus. When also excluding trade services, producer prices rose 0.4 percent on the month, twice as much as the previous month, lifting this 12-month rate to 3.1 percent from 2.8 percent, the highest level since April 2023. Producer prices in the US also proved sticky in April with the headline index up 0.5 percent after edging down 0.1 percent in March. The 12-month rate rose to 2.2 percent from 1.8 percent, the highest level in a year. Excluding food and energy, the index was also up 0.5 percent on the month and the 12-month rate came in at 2.4 percent, just above the 2.3 percent consensus. When also excluding trade services, producer prices rose 0.4 percent on the month, twice as much as the previous month, lifting this 12-month rate to 3.1 percent from 2.8 percent, the highest level since April 2023.

At the producer level, goods prices rebounded 0.4 percent after retreating 0.2 percent in March, lifting the 12-month rate to 1.3 percent from 0.8 percent, the highest level since March 2023. Food prices fell 0.7 percent on the month after appreciating 0.4 percent in March, and were up at a steady pace of 0.5 percent on the year. Energy was up 2.0 percent month-to-month and 1.0 percent from a year earlier, the largest 12-month advance since February 2023.

Services rebounded 0.6 percent in April after contracting 0.1 percent in March, accounting for nearly three-quarters of the April PPI advance. The 12-month rate rose to 2.7 percent from 2.4 percent, a level that was last matched in August 2023.

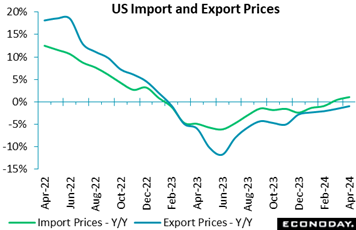

Imported inflation in the US unexpectedly accelerated in April, when the import price index rose 0.9 percent on the month, the largest gain since March 2022, topping even the highest forecast of 0.4 percent in Econoday’s survey. Reinforcing the picture was an upward revision to March's estimate to 0.6 percent from 0.4 percent. Prices were up 1.1 percent on the year, picking up from 0.4 percent in March and posting their largest increase since December 2022. Imported inflation in the US unexpectedly accelerated in April, when the import price index rose 0.9 percent on the month, the largest gain since March 2022, topping even the highest forecast of 0.4 percent in Econoday’s survey. Reinforcing the picture was an upward revision to March's estimate to 0.6 percent from 0.4 percent. Prices were up 1.1 percent on the year, picking up from 0.4 percent in March and posting their largest increase since December 2022.

Fuel import prices were up 2.4 percent on the month after advancing 5.4 percent in March and nonfuel prices were up 0.7 percent.

Following April's CPI report that showed core consumer prices were still up 3.6 percent year-over-year despite the slowdown from 3.8 percent in March, the import data confirm the last mile remains a challenge for the Federal Reserve.

Export prices also unexpectedly accelerated on the month, rising 0.5 percent after 0.1 percent in March, which was revised down from 0.3 percent. Econoday's consensus was 0.2 percent. Export prices contracted 1.0 percent year-over-year in April, after declining 1.6 percent in March, the smallest decrease since February 2023.

Agricultural export prices were down a further 0.9 percent in April, while non-agricultural export prices were up 0.7 percent after advancing 0.3 percent in the previous month.

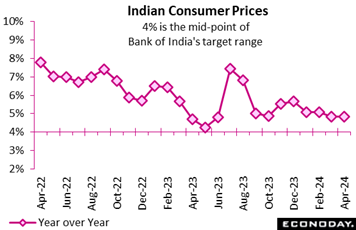

India's consumer price index rose 4.83 percent on the year in April, little changed from an increase of 4.85 percent in March. Inflation is now at its lowest level in nearly a year and closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent. India's consumer price index rose 4.83 percent on the year in April, little changed from an increase of 4.85 percent in March. Inflation is now at its lowest level in nearly a year and closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent.

Steady headline inflation reflects offsetting moves in major categories. Food and beverage prices rose 7.87 percent on the year, up from the previous increase of 7.68 percent, while fuel and light charges fell 4.24 percent on the year after a previous decline of 3.24 percent. Inflation in urban areas fell from 4.14 percent in March to 4.11 percent in April, while inflation in rural areas fell from 5.51 percent to 5.43 percent.

At the RBI's most recent policy meeting, held last month, officials left policy rates on hold at 6.50 percent. They advised then that they expect inflation to fall to around 4.5 percent in coming quarters but stressed that "the path of disinflation needs to be sustained" until inflation falls to 4.0 percent.

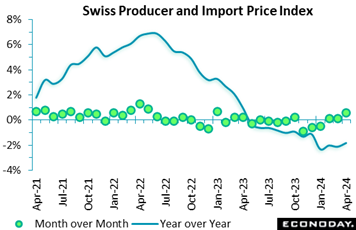

Switzerland’s combined producer and import price index rose again in April. A 0.6 percent monthly increase was well above the market consensus and sharp enough to lift the annual inflation rate from minus 2.1 percent to minus 1.8 percent, still weak but also a 4-month high. Switzerland’s combined producer and import price index rose again in April. A 0.6 percent monthly increase was well above the market consensus and sharp enough to lift the annual inflation rate from minus 2.1 percent to minus 1.8 percent, still weak but also a 4-month high.

Domestic prices increased 0.2 percent versus March, nudging up their yearly rate from minus 0.5 percent to minus 0.4 percent. Import prices saw a much steeper 0.8 percent gain, lifting their annual rate from minus 5.4 percent to minus 4.6 percent.

Within the PPI, petroleum products (7.9 percent) again saw the largest monthly rise and added almost 0.1 percentage point to the overall increase. Computer, electronic and optical products and watches (1.1 percent) as well as electrical equipment (also 1.1 percent) recorded hefty rises too alongside furniture and other manufacturing (1.9 percent). The sharpest declines were in electricity and gas supply (1.2 percent) and agricultural and forestry products (1.1 percent). Import prices were similarly boosted by higher petroleum costs (3.6 percent) and furniture and other manufacturing (4.0 percent). Consequently, overall core prices increased a relatively large 0.4 percent versus March although with base effects positive, the annual underlying rate was only unchanged at minus 1.7 percent. This matched its lowest mark since October 2020.

The April update shows that pipeline price pressures in Swiss manufacturing may be on the turn. Core prices seem to be picking up and, while not yet an issue for the SNB, will leave the central bank that much more cautious about cutting the policy rate again as soon as next month.

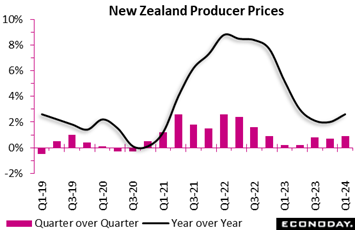

New Zealand producer output prices rose 0.9 percent on the quarter in the three months to March, up from the 0.7 percent increase recorded in the three months to December, with year-over-year growth picking up from 2.0 percent to 2.6 percent. The increase in headline producer price inflation reflects smaller declines in key sectors. Output prices in the manufacturing sector fell at a less pronounced rate, down 0.9 percent on the year after a decline of 3.5 percent previously, while prices in the primary sector fell 1.1 percent after a previous decline of 4.9 percent. Prices rose at a steady pace in most parts of the services sector. New Zealand producer output prices rose 0.9 percent on the quarter in the three months to March, up from the 0.7 percent increase recorded in the three months to December, with year-over-year growth picking up from 2.0 percent to 2.6 percent. The increase in headline producer price inflation reflects smaller declines in key sectors. Output prices in the manufacturing sector fell at a less pronounced rate, down 0.9 percent on the year after a decline of 3.5 percent previously, while prices in the primary sector fell 1.1 percent after a previous decline of 4.9 percent. Prices rose at a steady pace in most parts of the services sector.

Data released last month showed weaker consumer price pressures in the three months to March, with headline CPI inflation slowing to 4.0 percent from 4.7 percent in the three months to December, closer to the Reserve Bank of New Zealand's target range of one percent to three percent. Officials left policy rates on hold at their most recent meeting last month, reflecting their assessment that consumer price inflation is likely to moderate further in coming quarters. The next RBNZ policy meeting will take place in the coming week (see Looking Ahead for details).

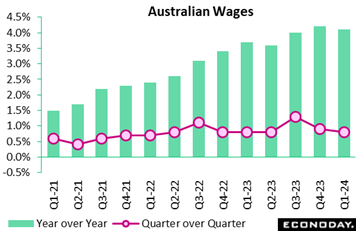

Australia's wage price index rose 0.8 percent on the quarter in the three months to March after advancing 0.9 percent in the three months to December, with year-over-year growth in the index inching lower from 4.2 percent to 4.1 percent. Monthly labour market data over that period showed ongoing low unemployment rates and participation rates close to record highs. Australia's wage price index rose 0.8 percent on the quarter in the three months to March after advancing 0.9 percent in the three months to December, with year-over-year growth in the index inching lower from 4.2 percent to 4.1 percent. Monthly labour market data over that period showed ongoing low unemployment rates and participation rates close to record highs.

The results underscore upside risks to inflation and are in line with an assessment made by officials at the Reserve Bank of Australia at their most recent policy meeting in the prior week that conditions in the labour market remain tighter than what is consistent with returning inflation to target. Officials noted then that "wages growth appears to have peaked but is still above the level that can be sustained given trend productivity growth."

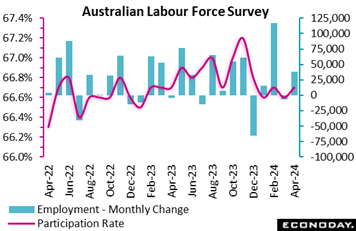

Labour market conditions in Australia were mixed in April, with employment rebounding from a previous decline, the unemployment rate picking up for the second consecutive month, and the participation rate increasing slightly. Labour market conditions remain relatively tight and April's update will likely do little to shift the focus of the Reserve Bank of Australia from the inflation outlook or strengthen the case for any easing in policy in the near-term. Labour market conditions in Australia were mixed in April, with employment rebounding from a previous decline, the unemployment rate picking up for the second consecutive month, and the participation rate increasing slightly. Labour market conditions remain relatively tight and April's update will likely do little to shift the focus of the Reserve Bank of Australia from the inflation outlook or strengthen the case for any easing in policy in the near-term.

The number of employed persons in Australia rose by 38,500 in April after falling by 5,900 persons in March. The consensus forecast was for an increase of 24,000. Full-time employment fell by 6,100 after a previous increase of 26,600, but this was offset by an increase in part-time employment of 44,600 after a previous decline of 32,500. Hours worked were flat on the month after increasing 0.9 percent previously.

April's data also show the unemployment rate rose from 3.9 percent in March to 4.1 percent in April. The participation rate rose slightly from 66.6 percent to 66.7 percent, remaining close to record highs.

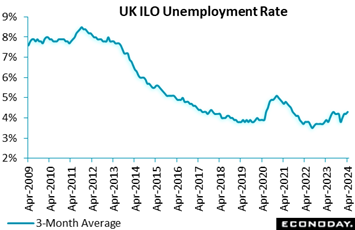

The UK’s March/April labour report paints a mixed picture with some further signs of cooling economic activity but also ominously high wage growth. ILO data for the three months to March showed the number of jobless climbing a sizeable 166,000, its steepest increase since the three months to November 2020. This was large enough to lift the jobless rate to 4.3 percent, in line with the market consensus but matching its highest print since the Covid-impacted third quarter of 2021. The UK’s March/April labour report paints a mixed picture with some further signs of cooling economic activity but also ominously high wage growth. ILO data for the three months to March showed the number of jobless climbing a sizeable 166,000, its steepest increase since the three months to November 2020. This was large enough to lift the jobless rate to 4.3 percent, in line with the market consensus but matching its highest print since the Covid-impacted third quarter of 2021.

Employment was again weak, falling a hefty 178,000 versus the fourth quarter. This was its worst performance since June-August last year but still left the employment rate steady at 74.5 percent. In addition, looking forward, vacancies in the three months to April dropped a further 26,000 to 898,000, their lowest mark since the second quarter of 2021.

However, wage developments were surprisingly robust. At a 5.7 percent rate, average annual growth in the first quarter was only unchanged from its upwardly revised reading in December-February and well above expectations. Similarly, the rate for regular pay was also sticky at 6.0 percent.

In sum, the new report provides something for the BoE MPC's doves and hawks alike. Overall labour market conditions are clearly easing but the market remains tight and, it seems, tight enough to prevent any additional progress on reducing pay growth. As such, the majority of MPC members are now probably rather less likely to vote for a June cut in Bank Rate.

France’s labour market was little changed at the start of the year. At 7.3 percent, the mainland jobless rate matched its fourth quarter reading and so still equals its highest level since the third quarter of 2021. The latest print was a tick above the market consensus. France’s labour market was little changed at the start of the year. At 7.3 percent, the mainland jobless rate matched its fourth quarter reading and so still equals its highest level since the third quarter of 2021. The latest print was a tick above the market consensus.

Including overseas territories, unemployment rose just 6,000 after a 30,000 increase in the previous period leaving the jobless rate steady at 7.5 percent. This was 0.4 percentage points above the recent low seen at the start of 2023. At the same time, the overall employment rate climbed 0.3 percentage points to 68.8 percent, largely due to an increase in the number of self-employed. The permanent rate was only flat at 50.7 percent but this matched the record high seen since INSEE began reporting the data in 2003.

In sum, the first quarter report shows a sluggish labour market, consistent with an economy struggling to achieve any real growth. Even so, at 20 and 18 respectively, both the French Relative Performance Index and index less prices (RPI-P) show economic activity in general continuing to run somewhat ahead of market expectations (see Bottom Line for details).

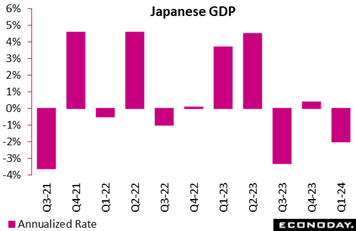

Japanese first-quarter GDP contracted a slightly deeper-than-expected 0.5 percent on quarter, or an annualized 2.0 percent, as suspended output at Toyota over a safety scandal triggered a widespread slump beyond the auto industry. The Cabinet Office estimates that in order for real GDP to hit the official forecast of 1.3 percent growth for fiscal 2024, the economy will have to grow 0.75 percent on quarter, or an annualized 3.1 percent in each quarter of the fiscal year that began in April. Japanese first-quarter GDP contracted a slightly deeper-than-expected 0.5 percent on quarter, or an annualized 2.0 percent, as suspended output at Toyota over a safety scandal triggered a widespread slump beyond the auto industry. The Cabinet Office estimates that in order for real GDP to hit the official forecast of 1.3 percent growth for fiscal 2024, the economy will have to grow 0.75 percent on quarter, or an annualized 3.1 percent in each quarter of the fiscal year that began in April.

Private consumption, which accounts for about 55 percent of GDP, fell 0.7 percent for a fourth straight quarterly decline, coming in much weaker than the median projection of a 0.2 percent fall and following a 0.4 percent drop in the fourth quarter. Consumption pushed down first quarter GDP by 0.4 percentage point after making a negative 0.2-point contribution to total domestic output in the previous quarter.

Business investment in equipment slumped 0.8 percent on quarter in January-March, firmer than the median forecast of a 1.2 percent drop. It was in payback for a sharp 1.8 percent rebound in October-December, the first rise in three quarters that was backed by continued solid growth in sales and profits. Capex made a negative 0.4-point contribution to first-quarter GDP after providing a positive 0.3-point contribution the previous quarter.

Net exports of goods and services -- exports minus imports -- made a negative 0.3 percentage point contribution to the total domestic output, coming in slightly firmer than the median forecast of a 0.4-point decrease after raising the GDP by 0.2 point in the previous quarter, which was supported by a one-off surge in services income. Japanese exports of goods and services posted their first quarterly decline in four quarters in the January-March quarter GDP, down 5.0 percent, after rising 2.8 percent in October-December. Imports also fell 3.4 percent after rising 1.8 percent in the previous quarter. The number of visitors from other countries has recovered to pre-Covid levels and their spending is counted as Japanese exports of services. By contrast, exports of goods have been sluggish amid a weak tone in the European economy and despite signs of a pickup in China.

Looking ahead, the economy in April-June is expected to show modest growth (about 1.7 percent annualized) as auto production resumed in March but consumer spending remains sluggish amid elevated costs for food and other necessities. Both households and businesses are concerned that the weakness of the yen, whose value has hit 34-year low against the dollar, will cause a resumed spike in import costs at a time when the prices for some commodities are rising.

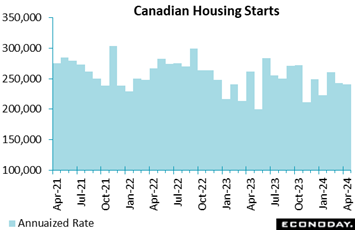

Housing starts in Canada fell 0.8 percent in April to a seasonally adjusted annual rate of 240,229 units, right in line with Econoday's consensus expectation of 240,000. The estimate for March was steady at 242,267 from 242,195 initially reported. The six-month trend for total housing starts declined 2.2 percent to 238,585 units. Housing starts in Canada fell 0.8 percent in April to a seasonally adjusted annual rate of 240,229 units, right in line with Econoday's consensus expectation of 240,000. The estimate for March was steady at 242,267 from 242,195 initially reported. The six-month trend for total housing starts declined 2.2 percent to 238,585 units.

Lower multi-unit starts in Ontario explained much of the decline in both the headline number and the six-month trend. Multi-unit volatility observed in Toronto, Vancouver, and Montréal in recent months is unsurprising given challenging borrowing conditions, a trend that Canada Mortgage and Housing, which publishes the report, expects to continue.

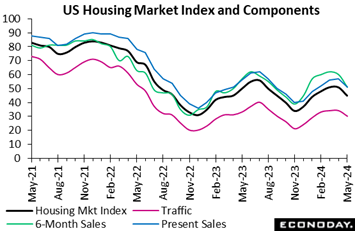

The US housing market index fell steeply from 51 in April to 45 in May which was far below expectations. The drop reflects homebuilders' adjustment to the reality that mortgage interest rates are unlikely to come down substantially in the near future as the Federal Reserve wrestles with inflation. The US housing market index fell steeply from 51 in April to 45 in May which was far below expectations. The drop reflects homebuilders' adjustment to the reality that mortgage interest rates are unlikely to come down substantially in the near future as the Federal Reserve wrestles with inflation.

The Freddie Mac average monthly rate for a 30-year fixed rate mortgage is at 7.09 percent for May to-date, slightly above the 7.04 percent in April and 6.82 percent in March. Although lean stocks of existing homes will continue to support homebuilding, there are fewer potential homebuyers in the market due to affordability issues while rates are higher along with prices.

Detail indexes show that homebuilders are less optimistic about both current and future conditions. The index for present sales is down 6 points to 51 in May and the expected sales index is down 9 points to 51. The buyer traffic index is 4 points lower at 30. Essentially, the improvements in perceptions of homebuilders in the first quarter 2024 when there was a respite in mortgage rates below the 7 percent-mark are now gone.

In separate data, housing starts rebounded 5.7 percent to 1.360 million units in April after 1.287 million units in March but was still well short of the 1.435 million consensus. Permits fell 3.0 percent to 1.480 million and were also below expectations. Though the housing market is getting a chill from mortgage rates over 7 percent, new construction has not fallen drastically. As long as supplies of existing homes remain lean, builders will find opportunities.

China's residential property prices fell 3.1 percent on the year in April, worsening from a decline of 2.2 percent in March. China's property market has been very weak for nearly two years, representing a major drag on investment and consumer spending. China announced plans in the week to support the housing market by buying unsold apartments, finishing unfinished homes, and easing mortgage rules. China's residential property prices fell 3.1 percent on the year in April, worsening from a decline of 2.2 percent in March. China's property market has been very weak for nearly two years, representing a major drag on investment and consumer spending. China announced plans in the week to support the housing market by buying unsold apartments, finishing unfinished homes, and easing mortgage rules.

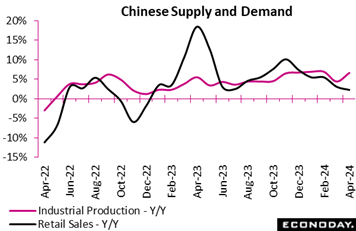

Other April data released in China included deeper-than-expected slowing in retail sales, to a year-over-year 2.3 percent from 3.1 percent in March, but greater-than-expected growth in industrial production to 6.7 percent from 4.5 percent. The latter was supported by 7.5 percent growth in manufacturing output. Other April data released in China included deeper-than-expected slowing in retail sales, to a year-over-year 2.3 percent from 3.1 percent in March, but greater-than-expected growth in industrial production to 6.7 percent from 4.5 percent. The latter was supported by 7.5 percent growth in manufacturing output.

Officials said the monthly data run shows that "the national economy was generally stable and continued to rebound and progress well". Although they acknowledged growth in some indicators moderated, they attributed this to the impact of lunar new year holidays and base effects. Officials also warned, however, that "the external environment is becoming more complex, severe and uncertain" and that the domestic economy still faces "multiple difficulties and challenges". They noted that they will seek to "frontload and effectively implement" macroeconomic policies, including efforts to support housing, that have already been introduced, suggesting that they do not yet see a case for a major shift in policy settings.

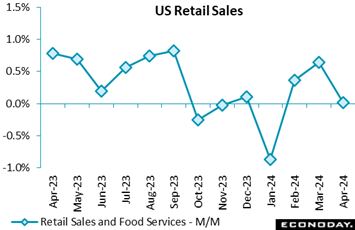

US retail and food services sales were unchanged in April following a 0.6 percent gain in March and well below the consensus for a 0.4 percent increase. Yet sales actually rose an as-expected 0.2 percent when excluding vehicles which fell 0.8 percent where a slight uptick in the number of units sold did not translate into a higher dollar amount, underscoring the decline in vehicle prices in April’s CPI report. Sales at gasoline stations rose 3.1 percent likely reflected both higher prices at the pump and greater volumes during the spring holiday travel period. US retail and food services sales were unchanged in April following a 0.6 percent gain in March and well below the consensus for a 0.4 percent increase. Yet sales actually rose an as-expected 0.2 percent when excluding vehicles which fell 0.8 percent where a slight uptick in the number of units sold did not translate into a higher dollar amount, underscoring the decline in vehicle prices in April’s CPI report. Sales at gasoline stations rose 3.1 percent likely reflected both higher prices at the pump and greater volumes during the spring holiday travel period.

In other components, it appears that the timing of the Easter holiday at the very end of March and coincidence with school spring vacations caused a shift in some spending patterns for seasonal merchandise. In particular, sales at general merchandise stores dipped 0.3 percent in April after rising 1.3 percent in March, and nonstore retailers – which include online shopping – declined 1.2 percent in April after increasing 2.5 percent in March. On the other hand, the warm weather in April sent shoppers out for clothing and accessories with a 1.6 percent gain at those stores after dipping 2.0 percent in the prior month.

The arrival of tax refunds may have had an impact on sales for electronics and appliances which rose 1.5 percent after falling 3.1 percent in March. Refunds may also have supported sales of building materials and garden supplies with a 0.5 percent increase in April after rising 0.4 percent in March. Consumers have been active in post-winter projects like home repairs and gardening.

Too much emphasis should not be placed on the April retail sales numbers in terms of a pull back in consumer in the second quarter of 2024. This is only one month's data. And it is often difficult to assess retail spending over the March/April period due to holiday timing which makes seasonal adjustment a challenge. It is better to read the two months together. In which case, consumers are spending modestly and consistently over time.

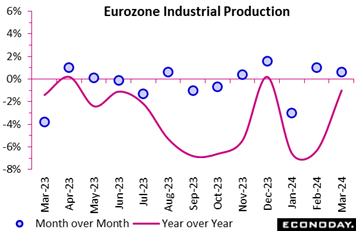

Industrial production in the Eurozone was a good deal stronger than expected in March. Following a steeper revised 1.0 percent monthly rise in February, output increased a further 0.6 percent. Annual workday adjusted growth climbed from minus 6.3 percent to minus 1.0 percent and, after taking on board earlier revisions, production has now expanded in four of the last five months. Industrial production in the Eurozone was a good deal stronger than expected in March. Following a steeper revised 1.0 percent monthly rise in February, output increased a further 0.6 percent. Annual workday adjusted growth climbed from minus 6.3 percent to minus 1.0 percent and, after taking on board earlier revisions, production has now expanded in four of the last five months.

However, growth came courtesy of the smaller member states as the larger four countries all recorded declines. Hence, France was down 0.3 percent, Germany 0.7 percent, Italy 0.5 percent and Spain 1.0 percent. This left Ireland (12.8 percent), where the statistics office is currently carrying out a review of its seasonal adjustment methodology, to shoulder much of the work.

Accordingly, the headline data probably flatter to deceive. Eurozone manufacturing may be over the worst but a full-blown recovery still looks some way off. As it is, the region's first quarter industrial production was 1.2 percent below its fourth quarter level.

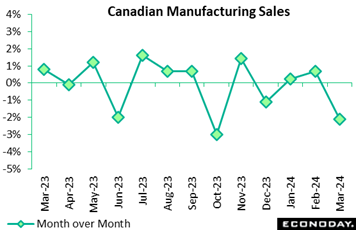

Manufacturing sales in Canada contracted 2.1 percent in March, the largest decrease since October 2023, albeit holding slightly better than expected. The retreat was mostly volume related as real sales were down 2.0 percent on the month. Sales dropped 3.1 percent year-over-year and declined 0.9 percent in the first quarter. Looking ahead, indicators are pointing to further weakness, as new orders were down 4.7 percent on the month and unfilled orders down 0.8 percent. Manufacturing sales in Canada contracted 2.1 percent in March, the largest decrease since October 2023, albeit holding slightly better than expected. The retreat was mostly volume related as real sales were down 2.0 percent on the month. Sales dropped 3.1 percent year-over-year and declined 0.9 percent in the first quarter. Looking ahead, indicators are pointing to further weakness, as new orders were down 4.7 percent on the month and unfilled orders down 0.8 percent.

Weaker activity was also expressed through a 0.3 percentage point decline in the capacity utilization rate to 78.0 percent in March, driven by non-durable goods industries.

Declines were widespread across 16 of 21 industries, led by an 8.0 percent fall in petroleum and coal and a 7.9 percent drop in motor vehicles. Excluding motor vehicles and parts, sales were still down 1.7 percent from February. In an encouraging sign for investment activity, however, machinery rose 2.9 percent on the month, one of four sectors recording higher sales.

Italy’s seasonally adjusted merchandise trade balance posted a healthy €4.17 billion surplus in March, albeit down from a smaller revised €5.78 billion in February. The deterioration reflected a 1.7 percent monthly fall in exports, their second drop so far this year, and a 1.5 percent rise in imports, their second straight gain following three successive declines. The slide in the former was driven by capital goods which slumped fully 7.7 percent and masked increases in both consumer goods (1.9 percent) and intermediates (0.8 percent). Energy fell 2.5 percent. Outside of energy (minus 1.4 percent), the advance in imports was broad-based. Italy’s seasonally adjusted merchandise trade balance posted a healthy €4.17 billion surplus in March, albeit down from a smaller revised €5.78 billion in February. The deterioration reflected a 1.7 percent monthly fall in exports, their second drop so far this year, and a 1.5 percent rise in imports, their second straight gain following three successive declines. The slide in the former was driven by capital goods which slumped fully 7.7 percent and masked increases in both consumer goods (1.9 percent) and intermediates (0.8 percent). Energy fell 2.5 percent. Outside of energy (minus 1.4 percent), the advance in imports was broad-based.

The March update puts first-quarter exports 1.1 percent below their level in the fourth quarter of last year and imports off a much steeper 4.4 percent. Accordingly, the trend in both sides of the balance sheet turned down. However, the latest data also widen the quarterly surplus from €10.95 billion to a sizeable €16.22 billion. Indeed, total net exports provided a boost to first-quarter GDP growth.

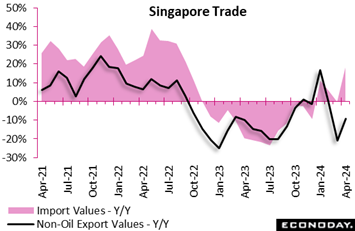

Singapore's non-oil domestic exports fell 9.3 percent on the year in April after falling 20.7 percent in March and fell 7.6 percent on the month after a previous decline of 8.5 percent. Imports rose 18.3 percent on the year in April after edging 0.1 percent lower in March and increased 4.3 percent on the month after an increase of 3.6 percent previously. Singapore's non-oil domestic exports fell 9.3 percent on the year in April after falling 20.7 percent in March and fell 7.6 percent on the month after a previous decline of 8.5 percent. Imports rose 18.3 percent on the year in April after edging 0.1 percent lower in March and increased 4.3 percent on the month after an increase of 3.6 percent previously.

Exports of electronics products increased 3.3 percent on the year after dropping 9.4 percent previously, while exports of non-electronic products fell 12.3 percent after dropping 23.2 percent previously. This year-over-year decline in non-electronic exports in April was largely driven by exports of pharmaceuticals, a category that is often very volatile. Exports to the European Union, South Korea, and the United States all fell sharply on the year in April but exports to China and Hong Kong grew at a faster pace.

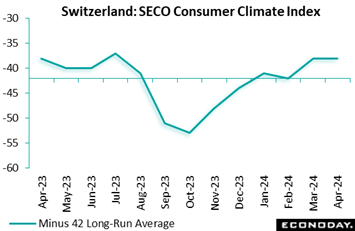

Household sentiment in Switzerland was unchanged in April. At minus 38, the unadjusted headline index matched both its March reading and its outturn a year ago and was a couple of points stronger than the market consensus. The measure duly remained above its minus 42 long-run average. Household sentiment in Switzerland was unchanged in April. At minus 38, the unadjusted headline index matched both its March reading and its outturn a year ago and was a couple of points stronger than the market consensus. The measure duly remained above its minus 42 long-run average.

Most of the components were broadly stable on the month although the economic outlook (minus 21 after minus 23) improved slightly. Job security (minus 21 after minus 22) was also marginally firmer but against that, buying intentions (minus 60 after minus 58) were modestly weaker. In terms of prices, the one year ahead inflation gauge (96 after 95) edged a little higher but was still well short of the levels seen over much of 2023.

Overall, the results just about leave a mildly improving trend in consumer confidence which should offer some support to spending over coming months.

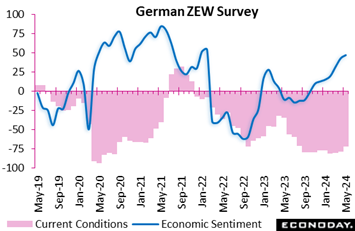

Germany’s ZEW survey found a further upgrade to analysts' assessment of the German economy. Both the current conditions and expectations gauges gained fresh ground in May making for a surprisingly strong report versus the market consensus. Germany’s ZEW survey found a further upgrade to analysts' assessment of the German economy. Both the current conditions and expectations gauges gained fresh ground in May making for a surprisingly strong report versus the market consensus.

Current conditions rose a further 6.9 points to minus 72.3, their third successive increase and a 9-month high. However, with the improvement from a very weak base the measure remains well short of its pre-Covid mark (minus 15.7). Meantime, economic sentiment (expectations) was up 4.2 points at 47.1. This gauge has increased every month since last July and a stronger reading has not been seen since February 2022.

The May results extend the upward trend seen in both measures over much of 2024 to date. Inflation is falling and with the ECB widely seen cutting interest rates next month, confidence is beginning to return. That said, the current state of the economy leaves much to be desired and manufacturing continues to struggle badly.

Econoday’s Relative Performance Index for the global economy moved a bit lower, ending the week at minus 7 and at minus 10 less inflation (RPI-P). The US, at minus 26 for the RPI and minus 39 for the RPI-P, is increasingly underperforming relative to expectations in a three-week slump that started with the April employment report and now includes April retail sales and April housing starts and building permits.

In contrast to the US, overall economic activity in the Eurozone continues to outperform market expectations, extending a pattern seen at the start of the month. An RPI of 32 and an RPI-P of 43 show forecasters still falling some way short on the pace of the recovery. Even so, subsiding inflation pressures should mean that a June cut in ECB interest rates is all but a done deal.

In the UK, a varied labour market report will help to ensure another split vote at June’s BoE MPC meeting. Yet economic activity is generally running well ahead of expectations. At 44 and 55 respectively, the RPI and RPI-P currently play into the hands of the more hawkish members.

Switzerland’s real economy continues to disappoint and the RPI-P ended the week at minus 20. Since early February, it has hardly broken above zero. However at 3, the RPI crept back into positive surprise territory (albeit only just) for the first time since mid-March. Reflecting unexpectedly firm producer prices, the RPI’s move may temper speculation about the SNB cuttings its policy rate again next month.

In Japan, the recent bias towards downside surprises was reflected in an unexpectedly sharp contraction in first quarter GDP. At minus 27 and minus 16 respectively, neither the RPI nor the RPI-P signal major shocks but both readings suggest that the BoJ needs to be careful over the timing of its next interest rate hike.

For China, a mixed bag of data last week was on balance weak enough to reduce the RPI to minus 21 and the RPI-P to minus 30. Having outperformed for most of March and early April, the latest readings will help sustain speculation that another cut in banks’ reserve requirements or even key interest rates cannot be ruled out.

Canada’s RPI (minus 13) and RPI (minus 7) both moved higher last week but neither gauge managed to break above the zero mark. Accordingly, a June ease by the BoC remains a possibility especially should Tuesday’s CPI report moderate as expected.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

No action is the wide consensus for both the Bank of New Zealand on Wednesday and the Bank of Korea on Thursday. The People’s Bank of China is not expected to cut its loan prime rates on Monday after the government’s move in the prior week to stabilize the housing sector. As for the US, Wednesday’s FOMC minutes may prove less useful than usual given how outspoken Federal Reserve officials have become in pushing back the outlook for rate cuts.

Canada’s CPI on Tuesday is expected to moderate to 2.7 from 2.9 percent as is Japan’s CPI on Friday to 2.4 from 2.7 percent, while the UK’s CPI on Wednesday is seen falling a full percentage point to a normal looking 2.2 percent. Thursday will see May’s run of PMI flashes which are expected to hold steady, showing general contraction for manufacturing and moderate expansion for services. UK retail sales on Friday are expected to be soft.

China Loan Prime Rates (Mon 0915 CST; Mon 0115 GMT; Sun 2115 EDT)

Consensus Change: 1-Year Rate: 0 basis points

Consensus Level: 3.45%

Consensus Change: 5-Year Rate: 0 basis points

Consensus Level: 3.95%

After holding steady in April, the People's Bank of China is expected to hold rates unchanged again at its May’s meeting: at 3.45 percent for the 1-year rate and 3.95 percent for the 5-year.

German PPI for April (Mon 0800 CEST; Mon 0600 GMT; Mon 0200 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: -3.1%

After edging 0.2 percent higher on the month in March, April’s PPI is seen rising 0.3 percent. Year-over-year, the PPI is expected to fall 3.1 percent versus 2.9 percent contraction in March.

Canadian CPI for April (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: 2.7%

After March’s slightly lower-than-expected 2.9 percent, consumer prices in April are expected to cool to 2.7 percent.

Japanese Machinery Orders for March (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, Month over Month: -1.1%

Consensus Forecast, Year over Year: 2.3%

Machinery orders are expected to fall 1.1 percent in March for year-over-year growth of 2.3 percent. Orders in February rebounded 7.7 percent on the month but were down 1.8 percent on the year. The government maintained its assessment in the last report, saying machinery orders “have weakened recently".

Japanese Merchandise Trade for April (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast: -Y295.9 billion

Consensus Forecast, Imports Y/Y: 8.8%

Consensus Forecast, Exports Y/Y: 11.1%

A deficit of ¥295.9 billion is the consensus for April’s trade balance versus a surplus of ¥387.0 billion in March that saw a strong gain for exports.

Reserve Bank of New Zealand Announcement (Wed 1400 NZST; Wed 0200 GMT; Tue 2200 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 5.50%

Though inflation has remained stubbornly high, at 4.4 percent in the first quarter, the Reserve Bank of New Zealand has been keeping policy steady. Consensus for May’s meeting is once again no change for the RBNZ’s policy rate at 5.50 percent.

UK CPI for April (Wed 0700 BST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 2.2%

At 3.2 percent in March, the CPI was slightly higher than expected and reflected continued price pressure for services. April’s consensus, however, is a ratcheting lower to 2.2 percent.

Bank of Korea Announcement (Thu 1000 KST; Thu 0100 GMT; Wed 2100 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 3.50%

Reflecting moderation in consumer prices, the Bank of Korea has kept policy unchanged since early 2023. No change is expected for its May meeting.

Singapore CPI for April (Thu 1300 SGT; Thu 0500 GMT; Thu 0100 EDT)

Consensus Forecast, Year over Year: 2.7%

Consumer prices in April, which in March cooled more sharply than expected to 2.7 percent from 3.4 percent, are expected to hold at 2.7 percent.

French PMI Flashes for May (Thu 0915 CEST; Thu 0715 GMT; Thu 0315 EDT)

Consensus Forecast, Manufacturing: 46.0

Manufacturing is seen at 46.0 in May versus April’s 45.3 and 46.2 in March.

German PMI Flashes for May (Thu 0930 CEST; Thu 0730 GMT; Thu 0330 EDT)

Consensus Forecast, Composite: 51.2

Consensus Forecast, Manufacturing: 43.5

Consensus Forecast, Services: 53.5

Manufacturing in April improved slightly but remained deeply depressed at 42.5. Further improvement is expected to 43.5 which, however, would still be deeply negative. Services, which in April jumped more than 3 points to 53.2, are seen at 53.5. Consensus for May’s composite is 51.2 following April’s 50.6 which was the first plus-50 expansion reading in 10 months.

Eurozone PMI Flashes for May (Thu 1000 CEST; Thu 0800 GMT; Thu 0400 EDT)

Consensus Forecast, Composite: 52.0

Consensus Forecast, Manufacturing: 46.3

Consensus Forecast, Services: 53.5

The composite is expected to further rise in May to 52.0 versus 51.7 in April and 50.3 in March. April’s result was the best in nearly a year. Manufacturing in May is expected at 46.3 versus April’s 45.7 with services expected at 53.5 after April’s better-than-expected 53.3.

UK PMI Flashes for May (Thu 0930 BST; Thu 0830 GMT; Thu 0430 EDT)

Consensus Forecast, Composite: 54.0

Consensus Forecast, Manufacturing: 49.4

Consensus Forecast, Services: 54.8

Manufacturing edged higher in April to 49.1 with May’s consensus at 49.4. Services growth picked up by nearly 2 points in April to 55.0 for the largest rise in 11 months. May’s consensus is a slight dip back to 54.8. May’s composite is expected to hold steady at 54.0 from April’s 54.1.

Japanese CPI for April (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast, Year over Year: 2.4%

Consensus Forecast, Ex-Fresh Food; Y/Y: 2.2%

Consensus Forecast, Ex-Fresh Food Ex-Energy; Y/Y: 2.5%

Consumer inflation in April is expected to ease to a year-over-year 2.4 percent versus 2.7 percent in March which compared with 2.8 percent in February. Excluding fresh food, the rate is seen at 2.2 percent versus March’s 2.6 percent. When also excluding energy the rate is seen at 2.5 percent versus March’s 2.9 percent.

Singapore Industrial Production for April (Fri 1300 SGT; Fri 0500 GMT; Fri 0100 EDT)

Consensus Forecast, Year over Year: 0.9%

Industrial production in April is expected to increase 0.9 percent following a 16.0 percent swing lower in March and a 14.6 percent swing higher in February.

UK Retail Sales for April (Fri 0700 BST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: -0.1%

Consensus Forecast, Year over Year: 0.4%

After no change percent in March which missed expectations for a 0.3 percent gain, volume sales in April are expected to slip a monthly 0.1 percent. Annual growth is seen falling by half, to 0.4 from 0.8 percent.

French Business Climate Indicator for May (Fri 0845 CEST; Fri 0645 GMT; Fri 0245 EDT)

Consensus Forecast: 100

Sentiment in French manufacturing unexpectedly deteriorated in April to 100 from 103 in March. May’s consensus is steady at 100.

US Durable Goods Orders for April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast: Month over Month: -0.5%

Consensus Forecast: Ex-Transportation - M/M: 0.2%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.1%

Forecasters see durable goods orders falling 0.5 percent in April following a 2.6 percent increase in March that saw gains concentrated in aircraft and vehicles. Ex-transportation orders are seen up 0.2 percent in April with core capital goods expected to edge only 0.1 percent higher for a second month in a row.

Canadian Retail Sales for March (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: -0.1%

Retail sales in March are expected to slip 0.1 percent on the month after slipping 0.1 percent and 0.3 percent in the two prior months.

Eurozone: EC Consumer Confidence Flash for May (Fri 1600 CEST; Fri 1400 GMT; Fri 1100 EDT)

Consensus Forecast: -14.0

Consumer confidence in May is expected to rise to minus 14.0 versus minus 14.7 and minus 14.9 in the two prior reports.

|