|

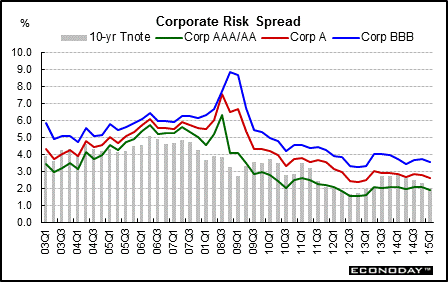

Long Term Perspective The 10-year Treasury note, rather than the 30-year bond, has become the benchmark security from which corporate interest rate levels are derived. All corporate bond yields in the charts below are rated by Citigroup Global Markets. Triple A rated bonds have the lowest risk of default, whereas Triple B bonds have the highest default risk among this group. Triple B bonds can be considered junk bonds, although distressed bonds are also rated "C" by some rating agencies.

Investors choose the amount of risk that they can tolerate. Those with low risk tolerance would choose the Treasury security for the lowest default risk, while investors with high risk tolerance might prefer the Triple B instrument with the highest default risk. A lower default risk comes with a lower yield; conversely, the higher the default risk, the higher the yield.

The spreads between Treasury securities and corporate bond yields are not uniform over the business cycle. Spreads widen during recessions when default risk is higher for all corporate bonds. Spreads narrow during boom times because default risk for all bonds diminishes when the economy is healthy.

Typically, Treasury securities have the lowest risk – and therefore the lowest yields. This was not always true between 2002 and 2005, although the 10-year Treasury note had a lower yield from mid-2005 into early 2009. The divergence in spreads is sometime due to the corporate rate including shorter maturities, which generate lower yields than those securities with longer maturities. The spread between average AAA/AA corporate bond yields and the 10-year note rose to minus 5 basis points in 2012 from minus 43 basis points in 2011 and then slipped down to minus 55 basis points by 2014.

Note: Citigroup's rating scheme differs from that of Moody's. Moody's broad categories begin with a capital letter (A, B, or C with A being the highest quality and lowest credit risk). Each broad category is differentiated into further subdivisions with a lower case "aa," "a," or no additional letter. For Moody's, the following are in descending order of quality – Aaa, Aa, and A. According to Moody's, obligations rated Aaa are judged to be of the highest quality, with minimal credit risk.

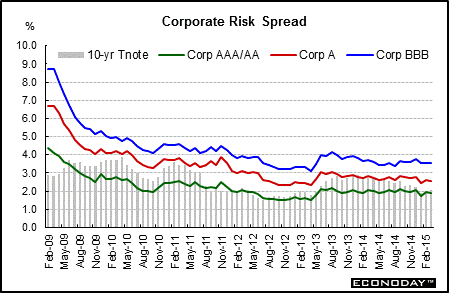

Short Term Perspective Most recently, there have been cross currents between worries about Fed ending of quantitative easing and flight to safety in the U.S. from events overseas. Rates were relatively level in 2014 but softened on flight to safety in early 2015.

For March, the AAA/AA rated yield fell 5 basis points to1.88 percent, the A corporate bond yield decreased 2 basis points to 2.57 percent while the rate on the BBB corporate bond dipped 3 basis points to 3.53 percent.

|

|||||||

| Legal Notices | ©Copyright 1998-2024 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||