|

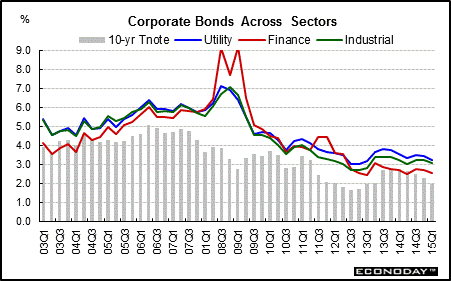

Long Term Perspective Equity investors know that various sectors of the economy perform differently over the business cycle. Thus, stock prices will ebb and flow with or against economic activity. Similarly, bonds in various sectors of the economy will bear different risk levels, just like stocks, depending on economic activity. For instance, among this group (utility, finance and industrial), traditionally finance sector bonds offered yields that were lower than the industrial and utility sectors, probably because these were viewed as having lower risks of default over the time horizon. This changed during the recent financial crisis and financial institutions' balance sheets were seen as suspect.

But during spring and summer of 2009, signs of easing in the recession and hints of recovery lowered spreads for utilities, finance, and industrials. This softening in spreads continued into 2011. Slower economic growth and Fed easing led rates down through early 2013. Slower growth in Europe and Asia was a concern in 2014.

Short Term Perspective Rates firmed in mid-2013 on improved economic news and on some concern that the Fed might start to unwind loose monetary policy sooner than earlier believed. Rates eased somewhat in early 2014 as it became apparent that the Fed would not likely accelerate taper beyond a scheduled and measured pace. Rates firmed late in 2014 as the end of quantitative easing in October 2014 became apparent and took place on schedule. But slower growth in Europe and Asia led to softer rates in early 2015.

In March, the spreads for finance, utilities, and industrial bonds stood at 49 basis points, 117 basis points, and 103 basis points, respectively.

In March, finance bonds decreased 2 basis points to 2.53 percent. Utility bonds declined 4 basis points to 3.21 percent. Industrial bonds fell 3 basis points to 3.07 percent in March while the 10-year Treasury note increased 6 basis points to 2.04 percent.

|

|||||||

| Legal Notices | ©Copyright 1998-2024 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||