|

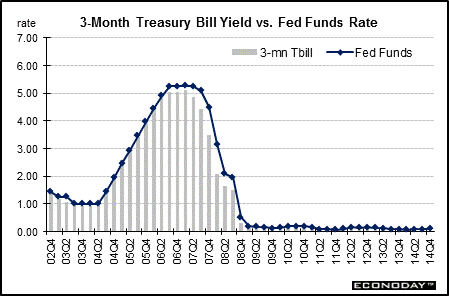

Long Term Perspective The yield on the 3-month Treasury bill is typically lower than the federal funds rate. In the 1980s, the 3- month bill averaged 64 basis points less than the funds rate, but in the 1990s this average fell to 18 basis points. The spread between the 3-month Treasury bill and the federal funds rate averaged minus 15 basis points between 2000 and 2014. This means that the 3-month bill yield was typically 15 basis points lower than the federal funds rate.

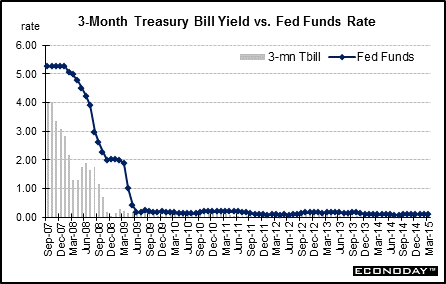

Short Term Perspective The gap between the 3-month bill and the fed funds target has shrunk back to more normal and negligible amounts now that the Fed has the fed funds rate essentially at zero and as of the January 27-28, 2015 plans to be "patient" for when the first rate hike occurs. Earlier, the negative gap widened during 2007 and accelerated in early 2008 as expectations rose for the Fed to cut rates and also on heavy flight to quality. Treasury rates fell over credit crunch concerns. Now, both the effective fed funds rate and the 3-month T-bill both are just barely above zero due to the Fed's rate cut going back to December 16, 2008. The Fed has said that policy rates likely will remain low for a considerable time with the Fed being patient about a return to normalization. And Treasuries are the markets' favorites for flight to safety. In March, the average yield on 3-month bills was up 1 basis point to 0.03 percent while the effective fed funds was unchanged at 0.11 percent (monthly average).

Values shown reflect monthly averages.

|

|||||||

| Legal Notices | ©Copyright 1998-2024 Econoday, Inc. |

powered by

![[Econoday]](images/logo.gif)

![[Apple App Store]](/images/AppleAppStore.png) ![[Econoday on Kindle]](/images/kindle.jpg)

|

||||||